Is the surge in GPUS stock a fleeting moment or a sign of long-term growth? A bold statement suggests that Hyperscale Data Inc. could redefine the data infrastructure landscape, making it an intriguing investment opportunity for those willing to take calculated risks.

Hyperscale Data Inc., trading under the ticker symbol GPUS on the American Stock Exchange, has recently captured the attention of investors with its dramatic price movements. The stock, which experienced a significant leap of over 300% at one point on May 05, 2025, reflects the growing interest in companies involved in cutting-edge technologies and scalable solutions. This meteoric rise was attributed to positive sentiment and substantial market developments that have positioned Hyperscale Data as a key player in the evolving tech sector. Investors are closely monitoring whether this upward trajectory will sustain itself or if it is merely a short-lived phenomenon driven by speculative trading.

| Category | Details |

|---|---|

| Name | Hyperscale Data Inc. |

| Ticker Symbol | GPUS |

| Exchange | American Stock Exchange (AMEX) |

| Sector | Technology |

| Current Price | $6.17 USD (as of latest update) |

| Price Change (24 Hours) | -39.35% |

| Market Capitalization | Data unavailable |

| Website | TradingView Reference |

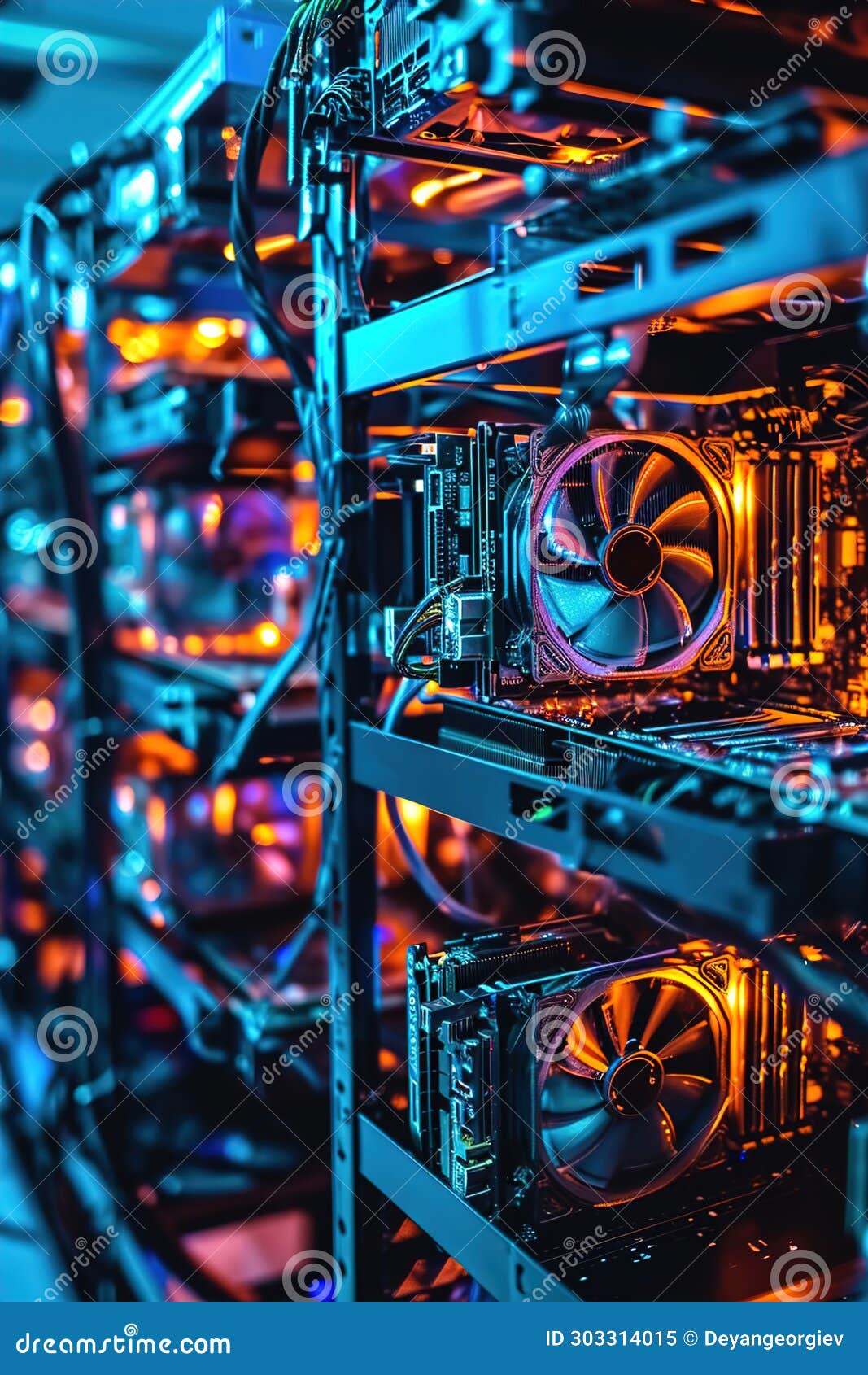

The recent performance of GPUS has been nothing short of remarkable, drawing comparisons to other high-growth stocks in the technology space. Analysts attribute much of the stock's success to the company's innovative approach to data storage and processing. Hyperscale Data Inc. specializes in creating scalable infrastructures designed to handle massive amounts of information efficiently. As industries increasingly rely on big data analytics and artificial intelligence, the demand for robust data management systems continues to grow. This trend aligns perfectly with Hyperscale Data’s core competencies, placing the company in a favorable position within the competitive marketplace.

Despite the optimistic outlook, caution remains paramount for potential investors. The volatility exhibited by GPUS underscores the inherent risks associated with investing in emerging technologies. While some experts believe the stock's ascent is justified given the company's promising innovations, others warn against overestimating its future prospects based solely on current trends. Historical data indicates that rapid price increases often precede corrections, meaning GPUS might experience downward pressure once the initial hype subsides. Therefore, thorough due diligence is essential before committing capital to this asset class.

For those interested in GPU availability—a topic closely related to Hyperscale Data’s operations—strategies such as visiting physical retail locations early in the morning or participating in online raffles may increase chances of securing desired hardware components. Micro Center stores, in particular, have become popular destinations for enthusiasts seeking reliable access to GPUs amid widespread shortages. However, these methods require patience and persistence since supply constraints persist globally due to manufacturing delays and increased consumer demand.

In addition to tracking GPUS stock prices through platforms like TradingView, staying informed about broader industry news can provide valuable insights into Hyperscale Data’s potential impact on the market. For instance, advancements in AI research and expanding applications across various sectors further validate the importance of efficient data handling capabilities. Companies capable of delivering scalable solutions tailored to meet evolving needs stand to benefit significantly from increased adoption rates worldwide.

Hyperscale Data Inc.'s journey thus far highlights both opportunities and challenges inherent in navigating today's dynamic financial environment. With ongoing developments shaping the landscape of modern computing architectures, understanding how firms like Hyperscale contribute to solving critical problems becomes increasingly important for stakeholders looking beyond traditional investment horizons.

As discussions around Alset AI Ventures Inc., another entity operating under the GPUS.V ticker, unfold concurrently, distinguishing between different entities sharing similar symbols proves crucial when analyzing individual performances. Although unrelated directly, comparing their trajectories offers additional context regarding prevailing conditions affecting smaller-cap players within respective niches.

Ultimately, while GPUS represents an exciting prospect worth exploring further, prudence dictates maintaining realistic expectations concerning possible returns. By balancing enthusiasm with analytical rigor, investors can better assess whether Hyperscale Data Inc. truly embodies transformative potential worthy of inclusion in diversified portfolios aimed at capitalizing on next-generation advancements driving global progress forward.