What drives the success of Berkshire Hathaway Inc., making it one of the most respected conglomerates in the world? A bold statement underpins this question: Warren Buffett's visionary leadership and strategic investments have transformed Berkshire Hathaway into a financial powerhouse. This company, with its diverse business activities spanning insurance, utilities, energy, and more, continues to captivate investors globally.

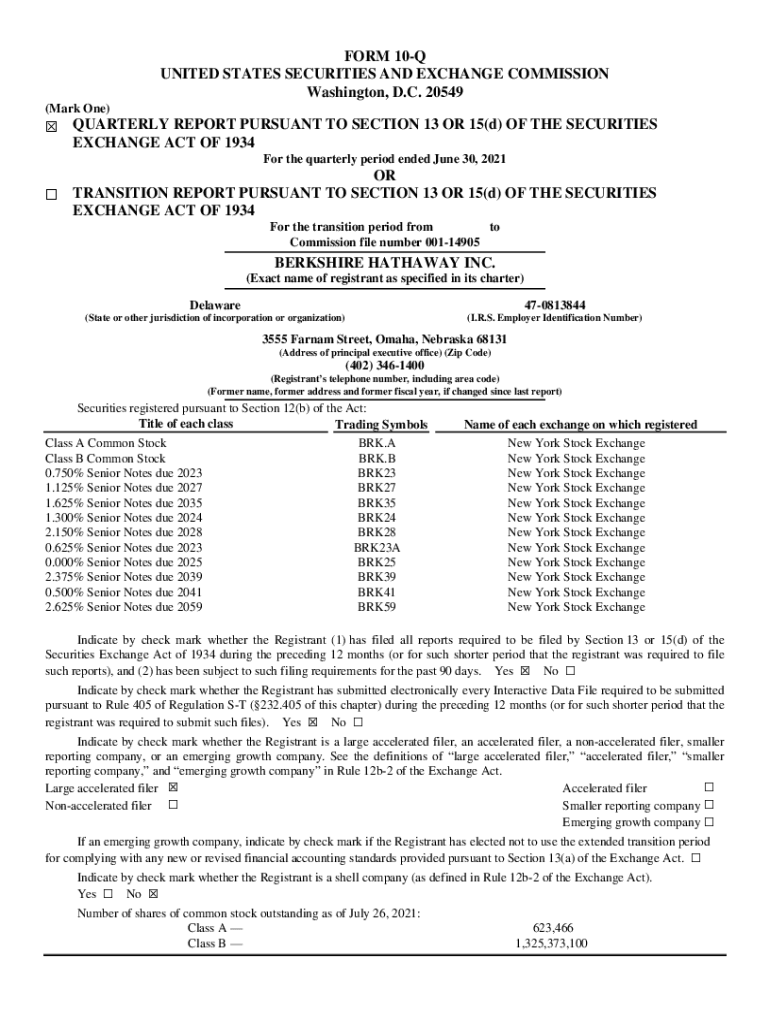

Berkshire Hathaway Inc., trading under the ticker symbols BRK.A and BRK.B, is not merely a stock but a testament to prudent financial management and long-term value creation. Investors interested in participating in this behemoth have two options: Class A stock (BRK.A) or Class B stock (BRK.B). While both represent ownership in the same company, they cater to different types of investors based on their investment capacity and objectives. The Class B shares offer a smaller slice of the company at a correspondingly smaller price, thus enabling a broader range of investors to own a piece of this financial giant.

| Personal Information | Details |

|---|---|

| Name | Berkshire Hathaway Inc. |

| Founder | Warren Buffett and Charlie Munger |

| Year Founded | 1839 (as Valley Woolen Company) |

| Headquarters | Omaha, Nebraska, USA |

| Website | Berkshire Hathaway Official Website |

| Stock Ticker | BRK.A, BRK.B |

| Industry | Conglomerate (Insurance, Utilities, Energy, etc.) |

The price-to-earnings (P/E) ratio, a critical metric for evaluating stocks, provides insight into how the market perceives Berkshire Hathaway's valuation. Derived by dividing the price per share of stock by the earnings per share for the most recent trailing 12 months, the P/E ratio offers a glimpse into whether the stock is overvalued or undervalued relative to its peers. For Berkshire Hathaway, given its diversified portfolio and consistent performance, the P/E ratio often reflects stability and investor confidence.

Nasdaq provides market information before the market opens daily from 4:15 AM ET to 7:30 AM ET. This pre-market data allows investors to gauge the sentiment surrounding Berkshire Hathaway Class B (BRK.B) shares ahead of the official trading session. BRK.B is frequently observed trading near the top of its 52-week range, indicating strong investor interest and confidence in the company’s future prospects. Moreover, its position above the 200-day simple moving average reinforces the bullish trend that has characterized the stock over recent periods.

Investors can buy or sell BRK.B shares through platforms like Robinhood, which offers commission-free trading for stocks, ETFs, and options. With real-time quotes, market data, and relevant news, Robinhood empowers traders to make informed decisions about their investments in Berkshire Hathaway. However, while trading costs are eliminated, users must remain aware of potential fees associated with other services provided by Robinhood Financial. For detailed fee information, visit

Berkshire Hathaway's prominence extends beyond mere stock performance; it encompasses a robust business model that integrates various sectors seamlessly. Its insurance and reinsurance operations form the bedrock of its financial strength, generating substantial cash flows that fuel further investments. Additionally, the company's utility and energy divisions contribute significantly to its revenue streams, ensuring diversification and resilience against economic fluctuations.

Real-time stock price quotes, graphs, and analysis available on platforms such as CNBC and The Motley Fool provide valuable insights into Berkshire Hathaway's market dynamics. These resources highlight key metrics, including price momentum and historical performance, enabling investors to assess the company's trajectory accurately. Furthermore, access to comprehensive financial information ensures that stakeholders remain well-informed about Berkshire Hathaway's operational health and strategic initiatives.

For those utilizing Excel to track stock prices, inputting BRKB retrieves the necessary data for Berkshire Hathaway B shares traded in the U.S. market. This functionality simplifies the process of monitoring stock performance and facilitates better decision-making for investors who rely on spreadsheet tools for financial analysis.

Beyond its core businesses, Berkshire Hathaway's commitment to corporate governance and ethical practices sets it apart in the competitive landscape. Under Warren Buffett's stewardship, the company prioritizes long-term value creation over short-term gains, aligning itself with the interests of shareholders and other stakeholders. This philosophy has earned Berkshire Hathaway a reputation for integrity and reliability, attracting a loyal following among investors worldwide.

In conclusion, Berkshire Hathaway Inc. exemplifies excellence in corporate management and investment strategy. Whether through its Class A or Class B shares, investors have the opportunity to participate in the growth story of one of the world's leading conglomerates. By leveraging advanced trading platforms, staying abreast of market developments, and adhering to sound investment principles, individuals can capitalize on the enduring appeal of Berkshire Hathaway's stock offerings.