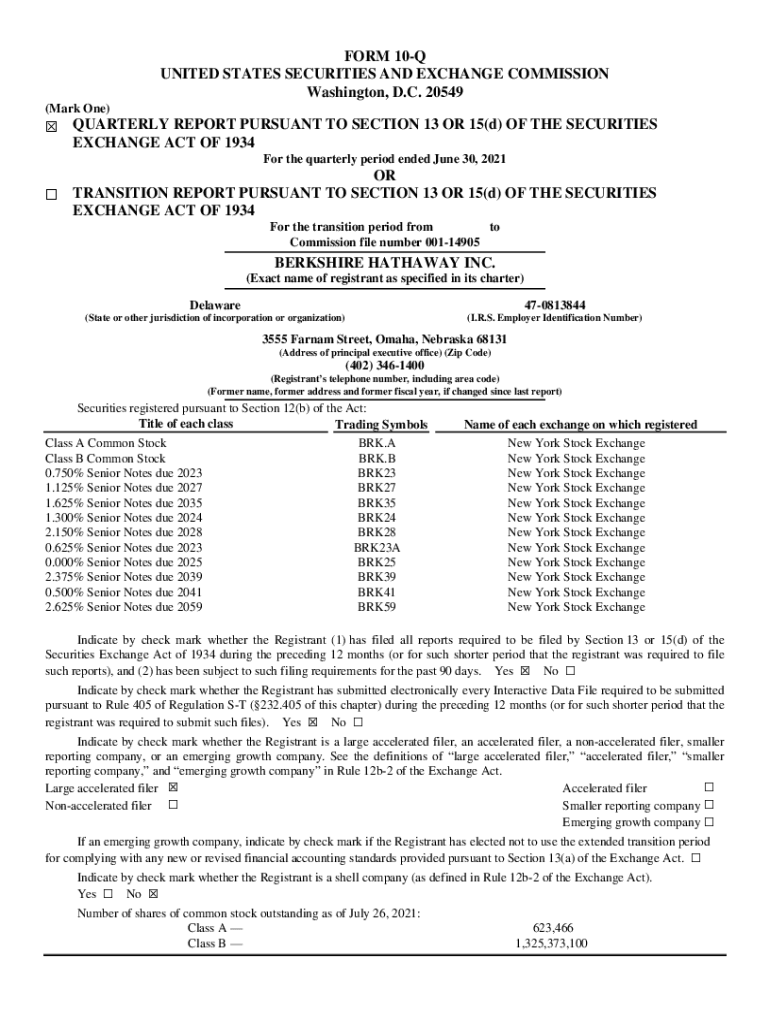

Why is Warren Buffett's Berkshire Hathaway outperforming the broader market and AI stocks? Berkshire Hathaway Inc. (BRK.B) has consistently delivered stellar returns, defying market corrections that have affected other sectors. This year alone, shares of the conglomerate led by one of the world’s most renowned investors are up over 16%, nearing record highs while many peers struggle in volatile conditions.

For shareholders of Berkshire Hathaway, it feels as though the stock market correction hasn’t even occurred. The company helmed by Warren Buffett continues to demonstrate resilience and growth, driven by its diverse portfolio spanning insurance, utilities, energy, freight, and more. Analysts attribute this performance to the company’s conservative financial management, robust cash reserves, and a focus on long-term value creation rather than short-term speculation. While tech-heavy indices like the Nasdaq and AI-driven stocks face scrutiny amid rising interest rates and economic uncertainty, Berkshire Hathaway remains steadfast, attracting both institutional and retail investors seeking stability and steady returns.

| Personal Information | Data |

|---|---|

| Name | Warren Edward Buffett |

| Date of Birth | August 30, 1930 |

| Place of Birth | Omaha, Nebraska, USA |

| Education | Columbia Business School, University of Pennsylvania |

| Net Worth (as of 2023) | $118 billion |

| Profession | Investor, Philanthropist, Businessman |

| Company | Berkshire Hathaway Inc. |

| Position | Chairman and CEO |

| Website | Berkshire Hathaway Official Website |

Berkshire Hathaway Inc., through its subsidiaries, operates across various industries, ensuring diversified revenue streams. Its insurance and reinsurance divisions contribute significantly to profitability, bolstered by strong underwriting discipline and disciplined investment strategies. Utilities and energy businesses further enhance earnings potential, capitalizing on renewable energy trends and stable demand for electricity. Freight operations, including Burlington Northern Santa Fe Railway, underscore logistical expertise, while manufacturing units produce everything from flooring to food products, catering to global markets.

The company’s commitment to shareholder value extends beyond financial metrics. Under Warren Buffett’s leadership, Berkshire Hathaway emphasizes corporate governance, transparency, and ethical practices. These principles resonate with investors during turbulent times when trust becomes paramount. Additionally, the firm maintains substantial liquidity—over $100 billion in cash equivalents at last report—positioning itself opportunistically for acquisitions or investments during downturns when asset prices decline.

Historical data supports Berkshire Hathaway’s track record of outperformance. Over the past three decades, BRK.B has consistently exceeded S&P 500 benchmarks, reflecting superior risk-adjusted returns. Even during periods when the broader market experiences declines, Berkshire Hathaway often posts positive gains due to its defensive positioning and emphasis on quality holdings. For instance, during the 2008 financial crisis, the company capitalized on distressed opportunities, acquiring stakes in firms such as Goldman Sachs and General Electric, which ultimately proved lucrative.

Recent developments highlight continued momentum. In 2023, Berkshire Hathaway announced several strategic moves reinforcing its competitive edge. One notable acquisition involved expanding its presence in the healthcare sector, aligning with demographic shifts favoring aging populations. Furthermore, the company increased dividend payouts, acknowledging growing investor expectations for income generation alongside capital appreciation.

Analysts remain bullish on Berkshire Hathaway’s prospects despite macroeconomic challenges. With inflationary pressures persisting and central banks tightening monetary policy, companies reliant on high leverage or speculative ventures may falter. Conversely, Berkshire Hathaway’s conservative approach positions it favorably, allowing it to weather storms while competitors falter. Moreover, succession planning efforts led by Greg Abel ensure continuity post-Buffett era, instilling confidence among stakeholders regarding future leadership.

In summary, Berkshire Hathaway Inc.’s ability to deliver consistent outperformance stems from prudent management, diversified operations, and adherence to timeless investing principles championed by Warren Buffett. As demonstrated throughout history, the company excels not only in bull markets but also in bearish environments where others falter. Investors considering exposure to equities would do well to evaluate BRK.B as part of their portfolios given its proven resilience and potential for enduring success.

| Key Financial Metrics | Values |

|---|---|

| Market Capitalization | $647 billion (approx.) |

| Price-to-Earnings Ratio | 25x |

| Dividend Yield | 0.7% |

| Revenue Growth (YoY) | 8.5% |

| Earnings Per Share (EPS) | $22.45 |

| Return on Equity (ROE) | 14.2% |

| Cash Reserves | $104 billion+ |

Real-time updates and detailed insights into Berkshire Hathaway’s performance can be accessed via reputable platforms such as MSN Money or CNBC. These resources provide comprehensive analyses, enabling investors to stay informed about key events influencing the stock’s trajectory. Whether tracking advanced charts, monitoring news headlines, or evaluating SmartSelect Ratings, staying abreast of developments ensures better decision-making aligned with individual financial goals.

Beyond quantitative measures, qualitative factors play a crucial role in assessing Berkshire Hathaway’s appeal. Cultural aspects rooted in integrity, innovation, and collaboration foster an environment conducive to sustainable growth. Employees, partners, and customers benefit from these values, creating synergies that amplify overall performance. Such intangibles contribute meaningfully to the brand’s enduring strength and relevance within today’s dynamic business landscape.