Is Berkshire Hathaway the epitome of a stable and profitable investment in today's volatile market? The answer lies in the numbers. As one of the most recognized conglomerates globally, Berkshire Hathaway has consistently demonstrated resilience and growth, even amidst economic uncertainties. Warren Buffett’s leadership has played a pivotal role in shaping the company into what it is today—a powerhouse with a diverse portfolio that spans multiple industries.

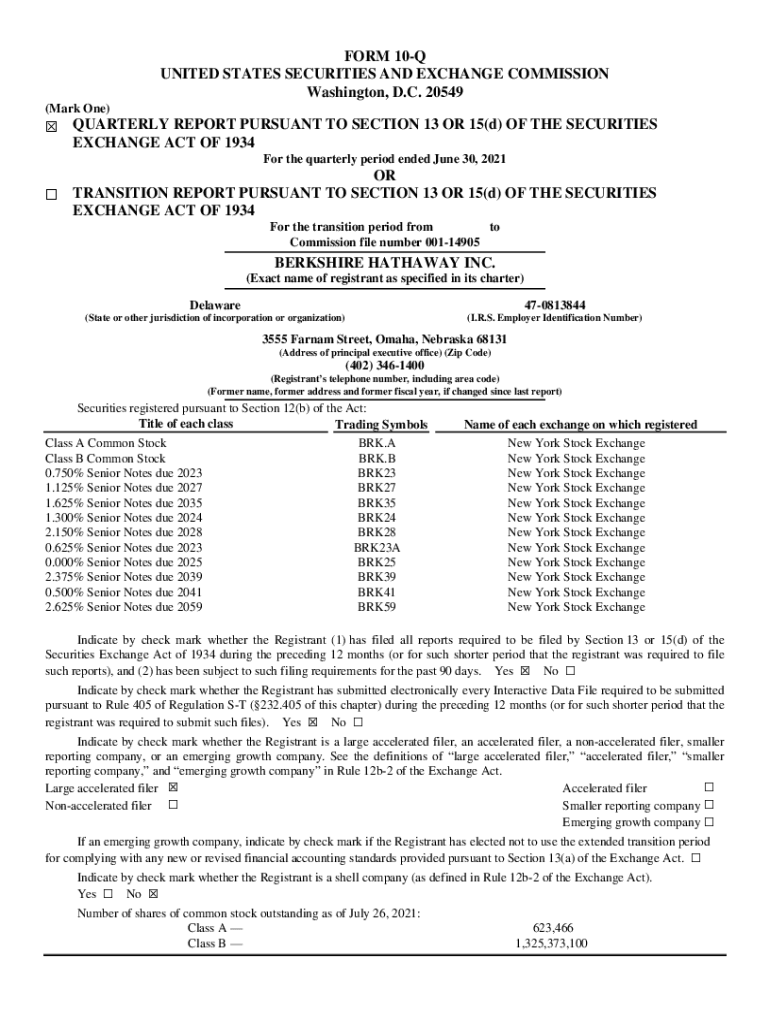

Berkshire Hathaway Inc., trading under two tickers—BRKA and BRKB—has established itself as a cornerstone for long-term investors. Both classes of shares have been making headlines recently, appearing on the new highs report on IBD MarketSurge. While Class A shares (BRKA) are significantly more expensive due to their higher value per share, Class B shares (BRKB), which underwent a 50-for-1 stock split in 2009, offer accessibility to smaller investors while maintaining proportional ownership benefits. This strategic move by Buffett ensured broader participation without diluting shareholder value.

| Category | Details |

|---|---|

| Name | Warren Buffett |

| Date of Birth | August 30, 1930 |

| Place of Birth | Omaha, Nebraska, USA |

| Education | University of Pennsylvania, University of Nebraska–Lincoln, Columbia Business School |

| Net Worth (as of 2023) | $118 billion |

| Career Highlights | - Chairman and CEO of Berkshire Hathaway since 1970 - Known as The Oracle of Omaha - Advocates value investing principles - Long-standing partnership with Charlie Munger |

| Professional Affiliations | Gates Foundation Co-Chair; Member of Giving Pledge |

| Reference Link | Berkshire Hathaway Official Website |

The price-to-earnings (P/E) ratio serves as an essential metric for evaluating Berkshire Hathaway's valuation. By dividing the current stock price by the earnings per share over the trailing twelve months, investors gain insight into whether the stock is fairly priced compared to its peers. For instance, if BRK.B trades at $518.30 per share and reports earnings per share of $35, the P/E ratio would be approximately 14.8. Historically, this figure aligns well with industry standards, reinforcing the notion that Berkshire Hathaway remains undervalued relative to its intrinsic worth.

Real-time updates on Berkshire Hathaway's performance are readily available through platforms like Robinhood, CNBC, and MSN Money. These resources provide not only live stock quotes but also detailed analyses of recent trends affecting the company. Investors can monitor key data points such as revenue growth, profit margins, and cash reserves—all indicators of Berkshire Hathaway's robust financial health. Moreover, access to news articles discussing strategic acquisitions or divestitures offers additional context when assessing potential future movements in share prices.

One notable aspect of Berkshire Hathaway's success stems from its diversified business model. Beyond insurance and reinsurance operations—which remain central to its core competencies—the conglomerate actively participates in sectors ranging from utilities and energy to freight transportation. Such breadth allows the company to mitigate risks associated with any single industry downturn while capitalizing on emerging opportunities across markets. Consequently, shareholders benefit from steady returns irrespective of macroeconomic conditions.

Consider the case of Berkshire Hathaway's recent outperformance against tech-heavy indices dominated by artificial intelligence stocks. Despite widespread enthusiasm surrounding AI-driven innovations, traditional blue-chip companies like Berkshire Hathaway continue to deliver impressive results. Year-to-date gains exceeding 16% underscore how Warren Buffett's disciplined approach prioritizes fundamentals over fleeting hype cycles. Furthermore, proximity to all-time highs suggests confidence among institutional buyers who recognize the underlying strength driving these achievements.

For those unfamiliar with Berkshire Hathaway's structure, understanding the distinction between Class A and Class B shares proves crucial. Although both represent equity stakes within the same corporation, they differ materially in terms of voting rights and cost per unit. Specifically, each Class A share confers 15 times the voting power of a corresponding Class B share yet commands exponentially greater monetary value. Thus, individual preferences dictate which option aligns best with personal investment objectives.

In summary, Berkshire Hathaway embodies stability amid uncertainty, offering attractive prospects for discerning investors seeking reliable returns. Whether analyzing historical metrics like P/E ratios or exploring contemporary developments influencing corporate strategy, there exists ample evidence supporting continued optimism about the company's trajectory. As always, prudent research coupled with informed decision-making ensures optimal outcomes aligned with long-term wealth creation goals.

| Key Financial Metrics | Values |

|---|---|

| Market Capitalization | $700+ billion |

| Revenue (FY 2022) | $318 billion |

| Net Income (FY 2022) | $40 billion |

| Dividend Yield | N/A (No regular dividends paid) |

| Major Subsidiaries | Geico, BNSF Railway, Clayton Homes, Dairy Queen, etc. |

| Top Holdings | Apple Inc., Bank of America, Coca-Cola Company, American Express |