Is Berkshire Hathaway's BRK.B stock the right investment for your portfolio? A bold statement supporting this query lies in the company’s consistent outperformance over the past three decades. Despite occasional setbacks, such as missing opportunities like Skechers or the recent decline following Warren Buffett's step down, Berkshire Hathaway remains a cornerstone of value investing. With its diversified business model spanning insurance, utilities, and energy, among others, it offers stability that many investors find appealing. This article delves into the nuances of BRK.B stock, analyzing its current position, historical performance, and future prospects.

Berkshire Hathaway Inc., led by legendary investor Warren Buffett, has been synonymous with prudent financial management and strategic acquisitions. Its Class B shares (BRK.B) provide an accessible entry point for retail investors who wish to participate in the conglomerate's success without committing significant capital. Over the years, Berkshire Hathaway has demonstrated resilience against market volatility, often delivering positive returns even during downturns. However, critics argue that the era of extraordinary growth may be waning as Buffett transitions leadership responsibilities. Nevertheless, the company continues to attract attention due to its robust fundamentals and commitment to shareholder value creation.

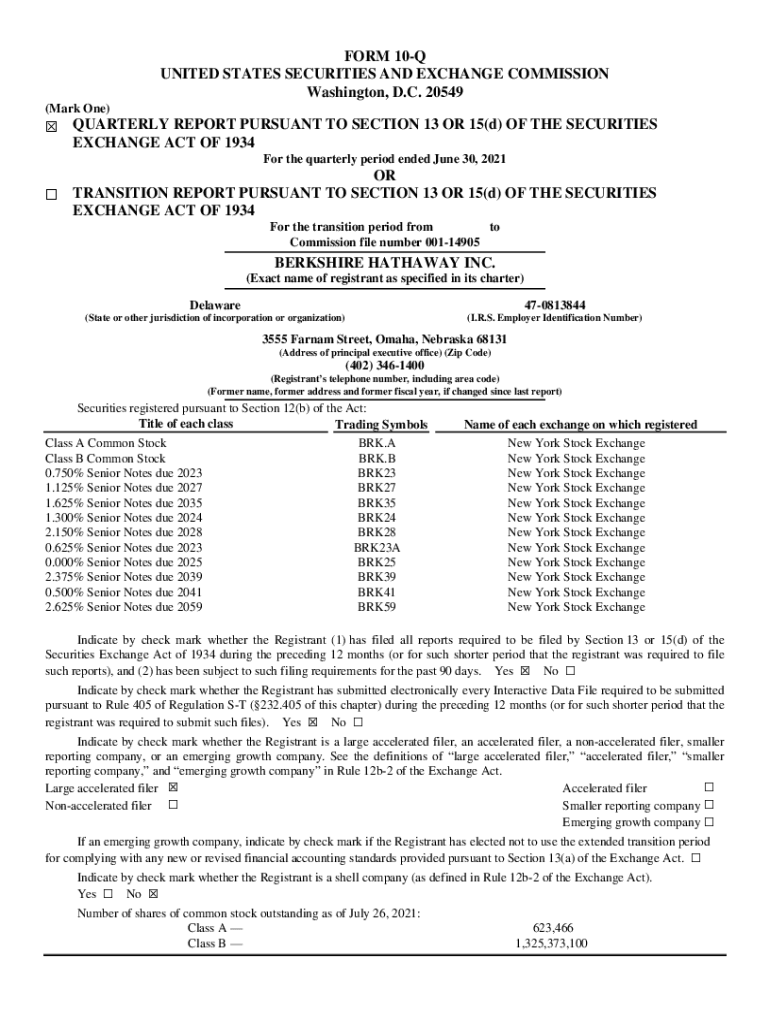

| Personal Information | Data |

|---|---|

| Name | Berkshire Hathaway Inc. |

| Stock Symbol | BRK.B |

| Headquarters | Omaha, Nebraska, USA |

| Founded | 1839 |

| CEO | Greg Abel (Post-Buffett Era) |

| Industry | Insurance, Utilities, Energy, Retail, etc. |

| Website | Berkshire Hathaway Official Website |

The stock's real-time trend reveals valuable insights into its performance. Currently trading near the upper end of its 52-week range, BRK.B is positioned above its 200-day simple moving average—a bullish indicator for long-term investors. While short-term fluctuations are inevitable, the underlying strength of Berkshire Hathaway's operations provides confidence in its ability to weather economic cycles. For instance, despite broader market declines, BRK.B has managed to post gains, underscoring its defensive characteristics.

Berkshire Hathaway's prowess extends beyond mere stock appreciation; it encompasses a holistic approach to wealth generation. Through subsidiaries like GEICO, BNSF Railway, and Clayton Homes, the conglomerate generates steady cash flows that fuel further investments. Moreover, the company maintains a substantial cash reserve, allowing it to capitalize on attractive acquisition opportunities when they arise. This disciplined strategy aligns perfectly with Buffett's philosophy of buying quality businesses at reasonable prices.

However, no investment is without risks. As Warren Buffett steps aside, concerns about succession planning have surfaced. Although Greg Abel, the newly appointed CEO, brings extensive experience and a proven track record, skeptics question whether he can replicate Buffett's magic. Additionally, regulatory challenges and changing consumer preferences could impact certain segments of Berkshire Hathaway's vast empire. Nonetheless, these uncertainties should not overshadow the company's enduring competitive advantages.

For those contemplating between BRK.B and index funds like the S&P 500, history offers compelling evidence favoring Berkshire Hathaway. Over the last 30 years, the conglomerate has consistently outperformed the broader market, delivering superior risk-adjusted returns. Furthermore, its unique structure allows shareholders to benefit from both equity appreciation and dividend income indirectly through retained earnings reinvested in high-quality assets.

Direxion Daily BRKB Bull 2X Shares (BRKU) presents another avenue for investors seeking enhanced exposure to Berkshire Hathaway's performance. By employing leverage, this exchange-traded fund aims to amplify daily returns, albeit at increased volatility. Investors must weigh their appetite for risk before venturing into such products, ensuring alignment with their overall financial objectives.

In summary, Berkshire Hathaway's BRK.B stock represents more than just a ticker symbol—it embodies a legacy of intelligent investing and prudent decision-making. Whether you're a seasoned professional or a novice looking to build wealth over time, incorporating BRK.B into your portfolio could prove beneficial. Of course, thorough research and due diligence remain essential prerequisites for any investment decision.

| Key Metrics | Values |

|---|---|

| Price Change (Year-to-Date) | -0.16% |

| Dividend Yield | N/A |

| P/E Ratio | Approximately 27x |

| Market Capitalization | $600+ billion |

| Annual Return (Last 5 Years) | Average 17.40% |

| Volatility | Lower compared to peers |

Investors considering BRK.B must also evaluate macroeconomic factors influencing its trajectory. Interest rate movements, inflationary pressures, and geopolitical developments could all play pivotal roles in shaping the company's future performance. Staying informed and adapting strategies accordingly will be crucial for maximizing potential rewards while mitigating risks.

Ultimately, Berkshire Hathaway's enduring appeal stems from its unwavering dedication to creating lasting value for stakeholders. As the world evolves, so too does the conglomerate's approach to navigating complex landscapes. By embracing innovation while preserving core principles, Berkshire Hathaway positions itself as a reliable partner for generations of investors yet to come.